Register Company in Oman

Imagine a land steeped in history and adorned with breathtaking landscapes – that’s Oman. Tucked away along the southeastern coast of the Arabian Peninsula, it’s a country that wears its rich heritage proudly. But it’s not just about its past; Oman thrives today with a bustling economy and a stable, business-friendly atmosphere. Here, local dreamers and global investors alike find a welcoming embrace as they look to make their mark in this vibrant region and they choose to register company in Oman.

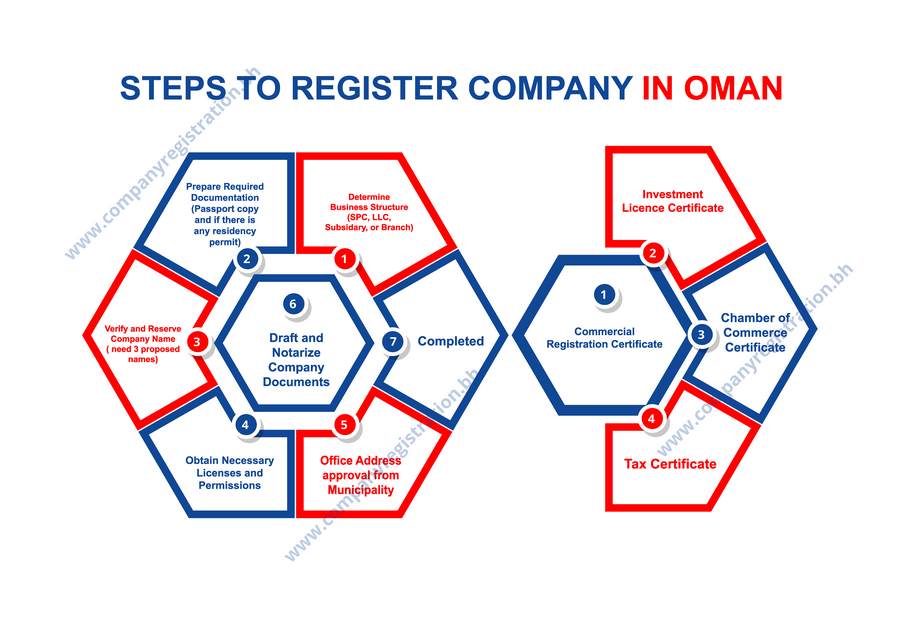

Registering a company in Oman involves a step-by-step process that ensures compliance with legal requirements. There are approximately 7 key steps involved in the journey to register company in Oman:

7 Easy Steps To Register Company in Oman

Now Lets Discuss Every Step To Register Company in Oman in Detail:

Step 1 Determine Business Structure (SPC, LLC, Subsidiary, or Branch)

When looking to register company in Oman, choosing the right business structure is crucial as it determines various aspects of your business, including liability, taxation, ownership, and operational requirements. Here’s an in-depth look at the common business structures:

Single Person Company (SPC):

An SPC is tailored for individual entrepreneurs looking to establish a business with a single shareholder, ensuring complete ownership and management control.

- Characteristics:

- Sole ownership grants full control and decision-making authority.

- Provides limited liability protection for the sole owner’s personal assets.

- Primarily suited for small-scale enterprises due to its simplicity and ease of management.

- Requirements:

- Mandatory requirement of a single individual as the sole shareholder.

- The shareholder must be a natural person, not a corporate entity.

- Characteristics:

Limited Liability Company (LLC):

LLCs are a prevalent choice for small to medium-sized businesses, offering a flexible structure with limited liability and operational flexibility.

- Characteristics:

- Requires a minimum of two shareholders and allows up to 40 shareholders.

- Limited liability confines shareholders’ responsibility to their capital contribution.

- Provides flexibility in management and profit distribution among shareholders.

- Requirements:

- Articles of association outlining company regulations.

- Minimum share capital and identification documents of shareholders are essential.

- Characteristics:

Subsidiary Company:

A subsidiary functions as a distinct legal entity controlled by another company, known as the parent company, allowing for independent operations under the parent’s ownership.

- Characteristics:

- Majority shares are owned and controlled by the parent company.

- Offers limited liability and autonomy in business operations.

- Facilitates the parent company’s expansion into Oman while maintaining control.

- Requirements:

- Standard incorporation documents similar to an LLC, alongside additional documentation establishing the relationship between the parent and subsidiary.

- Characteristics:

Branch Office:

A branch office represents an extension of a foreign company in Oman, operating under the same legal entity as the parent company.

- Characteristics:

- Conducts business under the policies and directives of the parent company.

- Limited liability extends to the parent company.

- Enables foreign entities to establish a presence in Oman without forming a separate legal entity.

- Requirements:

- Legalized documentation from the parent company and specific resolutions to establish the branch, along with standard registration documents.

- Characteristics:

Step 2 Prepare Required Documentation (Passport copy and if there is any residency permit)

When it comes to register company in Oman, the documentation phase is pivotal. It involves assembling specific documents that validate the identities and eligibility of the individuals involved in the establishment of the company. Ensuring the accuracy, validity, and compliance of all submitted documentation with the specific requirements outlined by Omani authorities is crucial for a seamless company registration process. Seeking guidance from legal professionals or experts well-versed in Omani business regulations can ensure that all documents are prepared accurately and in accordance with the registration prerequisites. This attention to detail during the documentation phase lays a solid foundation for a successful company registration process in Oman.

Here’s an in-depth look at the necessary documentation:

Passport Copy:

Importance: The passport copy is a fundamental requirement for all shareholders, directors, or partners, whether they are Omani nationals or foreign individuals.

Purpose: This document serves as a primary means of identification, offering essential personal details like name, date of birth, nationality, and a photograph.

Requirements: The passport copy should be legible, up-to-date, and include all pertinent pages showcasing personal information and the validity of the passport. For non-Omani individuals, a valid visa or entry stamp permitting business activities in Oman should accompany the passport copy.

Residency Permit (if applicable):

Importance: For foreign individuals residing in Oman, a residency permit or visa that validates their legal stay in the country might be obligatory.

Purpose: This official document authorizes non-Omani individuals to live and work in Oman, supporting their involvement in the company’s affairs.

Requirements: Copies of valid residency permits or relevant visas must be provided for foreign individuals involved in the company’s operations, holding positions such as shareholders, directors, or employees. These documents should comply with Omani immigration laws and regulations.

Additional Considerations:

Notarization and Legalization: Depending on the circumstances, documents might need notarization or legalization by relevant authorities or embassies to validate their authenticity, particularly for documents originating from foreign countries.

Translation: In instances where documents are not in Arabic or English, certified translations might be necessary to ensure their validity for official purposes in Oman.

Step 3 Verify and Reserve Company Name (need 3 proposed names)

Securing the right company name is a critical initial step in Oman’s company registration process. Let’s delve deeply into this phase to understand its nuances:

Verification of Company Name:

Significance: Selecting a company name goes beyond mere formalities; it’s the face and identity of the business. Therefore, the chosen name must be distinctive and comply with Omani naming regulations.

Criteria for Name Selection: Proposed names should steer clear of resemblance to existing company names and meet specific legal prerequisites. They must not infringe on trademarks, disrespect public ethics or morals, or cause confusion with established entities.

Verification Procedure: The process typically involves submitting an application to the relevant authority, often the Ministry of Commerce and Industry, for confirmation of the proposed name’s availability.

Reserving the Company Name:

Submission of Proposed Names: Registration protocols often require presenting a minimum of three proposed names in order of preference. This approach offers alternatives if the primary choice is already in use.

Approval and Reservation: After submission, authorities review the proposed names for availability and compliance with naming regulations. Upon finding the primary choice available and meeting regulations, it gets reserved for the applicant’s use, usually for a defined period (commonly 30 days).

Naming Restrictions: Certain terms or words might necessitate special approvals or could be restricted. Examples include terms related to government entities, religious connotations, or sensitive terms requiring additional permissions.

Documentation and Follow-Up:

Record Maintenance: Keeping thorough records of the proposed names submitted and the subsequent approvals or reservations is crucial. This documentation aids in the later stages of the registration process.

Timely Action: Prompt action is essential upon receiving approval and reservation of the preferred company name. Moving swiftly through the remaining registration steps within the allocated timeframe ensures securing the name officially.

Crucial Notes:

- Choose names that reflect the business’s essence, align with its values, and convey its purpose.

- Prepare alternative names to expedite the reservation process and prevent registration delays.

- Adhering strictly to naming regulations expedites approvals and ensures compliance with legal requirements.

Step 4 Get Necessary Permission & Licenses

Navigating the complexities of obtaining various permissions and certificates demands attention to detail, understanding of legal requirements, and compliance with regulations. Obtaining various permissions and certificates is a crucial phase in the process of company registration in Oman. Here’s a comprehensive breakdown of this step:

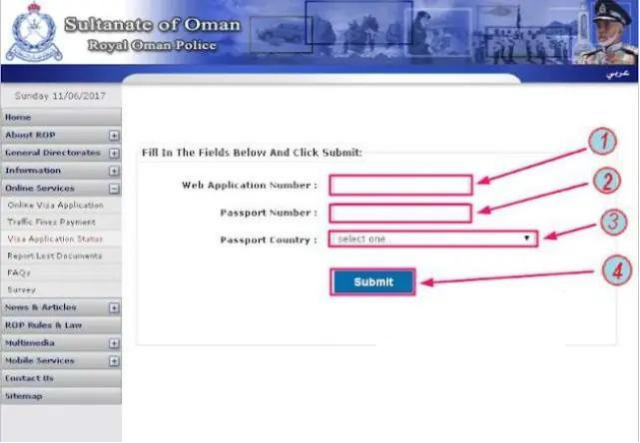

Police Clearance and No Objection Certificate (NOC):

Significance: Before commencing operations, companies often need a police clearance certificate or an NOC, especially for certain business activities. This certificate ensures the absence of legal issues or objections against the company.

Process: Companies usually apply to the local police department for the clearance certificate. This step involves submitting necessary documentation and undergoing background checks to ensure the absence of criminal records or legal obstacles.

Industry-Specific Certificates and Licenses:

Relevance: Certain industries or business activities require specific certifications or licenses to operate legally. These certificates verify the company’s compliance with industry standards and regulations.

Acquisition Process: Companies must apply to the relevant industry regulatory bodies or ministries for these certificates. This involves submitting documentation, meeting specific criteria, and undergoing inspections or assessments related to the industry’s requirements.

Labor Department Permissions:

Significance: Companies intending to employ individuals need approvals from the labor department. This ensures compliance with labor laws, including employee contracts, wages, working hours, and safety regulations.

Process: Companies submit applications to the labor department, detailing the intended employment practices. This involves providing employment contracts, salary structures, and workplace safety measures as per legal requirements.

Key Considerations:

Timeline and Documentation: Each permission or certificate acquisition process may have its own timeline and documentation requirements. It’s crucial to prepare and submit accurate and complete documentation within the specified timelines.

Compliance and Regulations: Adhering to Omani laws and regulations is imperative throughout the permissions and certificates acquisition phase. This ensures legal compliance and facilitates a smooth process to register company in Oman.

Contact Us Now For More Details

Step 5 Office Address approval from Municipality

Acquiring approval for your office address from the Municipality is a pivotal stage in the process to register company in Oman. This step involves several key aspects:

Importance of Office Address Approval:

Legal Mandate: Registering an official office address is a legal requirement for businesses in Oman. Approval from the Municipality is vital, confirming that the chosen location is suitable for conducting business operations.

Ensuring Compliance: Municipality approval signifies adherence to zoning regulations, building codes, and other municipal guidelines, ensuring the premises are appropriate for business activities.

Selection of Office Address:

Choosing the Right Location: Selecting an office address involves considering business needs and ensuring compliance with zoning laws.

Meeting Space Requirements: The office space should meet specified criteria in terms of size, amenities, and conformity with zoning regulations for commercial operations.

Application Process for Approval:

Submission Procedures: Once the office address is finalized, an application for approval is submitted to the Municipality.

Documentation Requirements: Essential documents include lease agreements or proof of ownership for the office premises, a No Objection Certificate (NOC) from the property owner, architectural plans, and other specifics as per the Municipality’s regulations.

Municipality Inspection:

Verification and Compliance Check: Municipality officials might conduct an inspection to ensure the office space aligns with the submitted plans and complies with their standards.

Comprehensive Compliance Review: Inspections verify adherence to safety standards, structural integrity, and zoning regulations.

Issuance of Approval Certificate:

Approval Confirmation: Upon successful verification and alignment with regulations, the Municipality issues an approval certificate for the office address.

Validity Period: Typically, the approval comes with a specific validity period, within which the company is expected to initiate operations at the registered address.

Post-Approval Considerations:

Legal Implications: The approved office address becomes the official registered location of the company, fulfilling legal prerequisites.

Initiating Business Operations: With the approved address, the company can proceed with subsequent registration steps, including obtaining trade licenses and officially commencing business activities.

Critical Considerations:

Regulatory Adherence: Ensuring the office address complies with all municipal regulations is crucial.

Documentation Precision: Submitting comprehensive and accurate documentation is imperative for a seamless approval process.

Step 6 Draft and Notarize Company Documents

Drafting and notarizing company documents are pivotal stages in the process of registering a company in Oman. Here’s a detailed exploration of this critical step:

Significance of Company Documents:

Legal Foundation: These documents, notably the Articles of Association and Memorandum of Association, establish the legal structure and governance framework of the company.

Operational Blueprint: They serve as guiding principles, delineating shareholders’ rights, operational procedures, decision-making protocols, and the company’s objectives.

Drafting Company Documents:

Articles of Association: This document outlines internal regulations, defining the company’s operational guidelines, shareholder rights, profit distribution, and administrative protocols.

Memorandum of Association: It elucidates the company’s objectives, scope of activities, registered office address, share capital, and the relationship between shareholders and directors.

Notarization Process:

Notary Public Verification: Post-drafting, these documents undergo notarization by a Notary Public, ensuring their authenticity and legal validity.

Authentication Procedure: Notarization involves validating the documents, confirming signatures, and affirming the identities of signatories.

Submission and Authentication:

Regulatory Compliance: Notarized documents are mandatory for company registration in Oman. These documents are submitted to relevant government authorities as part of the registration process.

Government Validation: Authorities authenticate the notarization to verify the documents’ legitimacy before advancing the registration process.

Post-Authentication Procedures:

- Document Preservation: Once notarized, these documents become crucial legal records for the company. Safeguarding copies in a secure location is vital for future reference and compliance.

Role of Legal Advisors:

Legal Expertise: Seeking counsel from legal professionals well-versed in Omani corporate laws is prudent. They ensure accuracy and compliance of company documents with local regulations.

Tailored Documentation: Legal advisors customize these documents to align with the company’s specific requirements while meeting legal obligations and safeguarding the company’s interests.

Key Considerations:

Precision and Detailing: Meticulousness in drafting and notarizing documents mitigates potential discrepancies or legal challenges in the future.

Adherence to Regulations: Ensuring documents comply with Omani corporate laws is crucial for seamless registration and operational continuity.

Process Completed Get Final CR

Everything is done and you can get final CR. In Oman, the Commercial Registration (CR) is the final step in the company registration process. It is an essential document that formally recognizes and authorizes a business entity to operate within the Sultanate. Acquiring the CR signifies the completion of all required procedures and approvals, culminating in the official establishment of the company within the Omani business landscape.

Benefits of Obtaining the CR:

Legitimacy and Authorization: The CR serves as the legal identity and authorization for the company to conduct business activities within Oman. It validates the company’s existence and ensures compliance with Omani laws and regulations.

Access to Government Services: Having a CR enables businesses to access various government services, apply for trade licenses, and participate in government tenders or contracts, thereby expanding opportunities for growth and collaboration.

Credibility and Trust: Possession of a CR enhances the company’s credibility in the eyes of clients, suppliers, and financial institutions. It establishes trust and confidence among stakeholders, facilitating smoother business transactions and collaborations.

Compliance and Governance: Holding a CR mandates adherence to legal and regulatory requirements. It promotes a structured and transparent operational framework, fostering good governance practices within the company.

Business Expansion: With a valid CR, companies can expand their operations, open branches or outlets, and engage in various commercial activities across Oman’s diverse business landscape.

Legal Protections: The CR provides legal protection to the business entity, outlining its rights, responsibilities, and obligations, shielding it against potential legal disputes or challenges.

Important Steps After Getting The CR:

Obtaining the Taxation Certificate:

Once a company secures the Commercial Registration (CR) in Oman, the subsequent steps involve acquiring essential certificates for seamless operations. One crucial document is the Taxation Certificate. It signifies compliance with tax regulations and serves as proof that the business entity is registered for taxation purposes. This certificate is typically obtained from the Oman Tax Authority and is crucial for fulfilling tax obligations, filing returns, and ensuring adherence to the country’s tax laws.

Obtaining the Chamber of Commerce Certificate:

The Chamber of Commerce Certificate holds significance for businesses seeking to engage in local and international trade. This certificate is acquired from the Chamber of Commerce and Industry and serves as a testament to the company’s membership and participation in the local business community. It facilitates networking opportunities, access to business resources, and involvement in Chamber-related activities, furthering the company’s visibility and credibility within Oman’s business landscape.

Obtaining the Investment License:

Securing an Investment License is crucial for companies intending to invest in specific sectors or activities in Oman. This license is typically issued by the Ministry of Commerce, Industry, and Investment Promotion or other relevant authorities. It grants permission for certain investments, demonstrating compliance with investment laws and regulations. The Investment License is essential for businesses aiming to engage in specialized sectors, encouraging and regulating foreign investments while ensuring adherence to Omani investment policies.

Importance of these Certificates:

Compliance and Legitimacy: Each of these certificates solidifies the company’s compliance with specific regulatory requirements in Oman.

Facilitating Business Operations: These certificates enable businesses to navigate regulatory environments, fulfill legal obligations, and participate actively in commercial activities within the country.

Enhancing Credibility: Possession of these certificates enhances the company’s credibility, facilitating smoother interactions with authorities, clients, and partners.

Corporate Bank Account: Important Business Requirement

Significance of a Corporate Bank Account:

Establishing a corporate bank account is a critical step for companies registered in Oman. This dedicated account serves as the financial nucleus, streamlining monetary transactions, facilitating payments, and managing day-to-day finances. It ensures a clear demarcation between personal and business finances, crucial for accounting accuracy, financial reporting, and regulatory compliance.

Role and Importance:

The significance of a corporate bank account lies in its multifaceted role. It enables seamless transaction management, empowering businesses to process payments, handle cash flows, and conduct both local and international financial dealings. Furthermore, it bolsters the company’s professionalism and credibility, presenting stability and integrity when engaging with stakeholders, clients, suppliers, and financial institutions.

Financial Operations and Compliance:

Moreover, this specialized account streamlines HR-related financial functions, such as salary disbursements and employee financial management, promoting organizational efficiency. It also reinforces compliance with financial regulations, aids in audits, and upholds transparent financial records, vital for regulatory adherence and demonstrating financial transparency.

Necessity of Registering a Company in Oman:

Access to Market and Compliance:

The necessity of registering a company in Oman becomes apparent for various reasons. Registration grants access to the local market, enabling participation in commercial activities and fostering competition in Oman’s diverse business milieu. It ensures adherence to Omani laws and regulations, laying the legal groundwork for conducting business within the country.

Legal Framework and Expansion:

Moreover, a registered company can efficiently navigate tax regulations, obtain essential licenses, and fulfill regulatory obligations. This avenue of registration opens doors for business expansion, including establishing branches, forging partnerships, and engaging in government tenders or contracts. Additionally, it solidifies credibility among stakeholders, clients, and investors, cultivating trust and reliability in the business.

Our Office in Oman

Location

Office No. 505 Building No. 1532 Road No. 3519 Block No 235 Alkhuwair Muscat, Oman

FAQs

Yes, some sectors like Trading allow 100% Foreign Ownership.

Common business structures in Oman include Limited Liability Company (LLC), Joint Stock Company, and branch offices of foreign companies.

It only take 10-15 days to complete company formation in Oman.

The process involves selecting a business structure, reserving a trade name, preparing legal documents (Articles of Association), obtaining necessary approvals, and completing registration with the Ministry of Commerce and Industry.

Yes, it is possible to hire foreign employees, but the process involves obtaining work permits and ensuring compliance with labor regulations.

To register a company legally at a low cost in Oman, minimize unnecessary expenses, utilize online registration services provided by government authorities, select a business structure aligned with your budget, and seek guidance from local business advisors for cost-effective compliance with legal requirements.

Starting an offshore business in Oman involves engaging with a registered agent, selecting a suitable jurisdiction, submitting the required documentation, obtaining necessary approvals from regulatory authorities, and adhering to the specific regulations and procedures set by the Oman government for offshore entities.

Yes, some sectors now allow foreign ownership.

Company formation in Saudi Arabia involves a structured process, including obtaining necessary approvals, drafting legal documents, and registering with relevant authorities, with complexities depending on business type and industry, often requiring guidance from local experts.

Yes, it is possible to drive from Bahrain to Saudi Arabia via the King Fahd Causeway, a bridge connecting the two countries.

To use the Shopify payment gateway in Saudi Arabia, integrate a supported payment provider compatible with the region, such as 2Checkout or PayTabs, through your Shopify admin panel, and configure the payment settings to enable seamless transactions for your online store.

The largest oil company in Saudi Arabia is Saudi Aramco, a state-owned enterprise that is one of the world’s leading oil and gas companies.